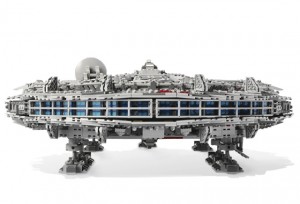

Released less than ten years ago in 2007, the Millenium Falcon (10179) quickly became the crowning jewel of any Lego fan’s collection. At an imposing 5174 parts, this Ultimate Collector’s Series set was a monolithic masterpiece, challenging even the most devout Lego fan to days worth of solid building. To date it is the largest Lego set that has ever been released.

The set however has recently been causing waves in the Lego community for reasons other than its impressive size and prestige. In a mere nine years the set has climbed in value from its original price tag of £340 to more than ten times that and is roughly valued at a staggering £4000. This is a huge return on any investment in such a short space of time and armed with examples like this the interest in investing long-term in Lego products has been rapidly increasing.

Guaranteed returns from Lego investments are no longer dubious, nor have they been for some time. Recent studies have shown that investors have enjoyed a greater annual gain from Lego in recent years than in gold or silver.

The website brickpicker.com is devoted to analyzing the market according to Lego. Its contribution to the Lego investing sector is invaluable. It provides data about the current and past value of Lego sets and measures growth and profitability. It also provides some excellent discussion forums where issues and concerns about Lego investing are addressed.

Some of the more interesting topics, particularly for for those new to Lego investing include: “How to begin to invest in Lego”; “The nature of the Lego market” and; “Which are the best Lego sets to invest in right now?”

Speaking as someone who’s now been investing in Lego for 16 years myself, I would have to caution that this market can be a gold mine, but like any other market, it is extremely complicated, difficult to predict and fraught with danger. This is by no means meant to be a dissuasive measure on my part, but rather an opportunity to explain the Lego market, albeit briefly.

The factors that go into determining the value a Lego set will have in future years are difficult to ascertain in the best of circumstances. It is true that there are some constants, however the list of variables in this case also include future unknown variables that are difficult to predict when it comes to Lego.

This is because the idea of the Lego set as a collectible gained momentum around the year 2000 when Lego began to acknowledge, respond to and produce for its AFOL (Adult Fans of Lego) market. The market therefore is relatively new and uncharted which makes it more prone, in some ways to instability.

The question of which Lego sets one should invest in to gain maximum return is a complex one and should not be approached lightly if one is looking to seriously invest in Lego.

It is imperative to understand when investing Lego, that this market is a market unto itself. It has its own products, its own rules and its own incongruities. And as it is also very new, its long-term implications have never really been tested. Affected as it is by other global markets and social concerns it becomes even more difficult to predict the long-term growth of this asset.

Bearing this in mind, all I am essentially saying is that the Lego market should probably not be entered too brashly. I think investing in any Lego set is a great idea because Lego is a fantastic investment, but there are definitely sets you should buy and sets you shouldn’t and in the long run, most of the time, only time will tell which sets are which.

The Millenium Falcon is a magnificent set and is rightly going up in value as a true collector’s item, but the same can’t be said for most Lego sets that are released,

Visit brickyourself.com.au to keep regularly updated on weekly hints and tips topics with regards to investing in Lego.

BrickManDan